- Brand Advocacy

- Customer Loyalty

- Loyalty

Luna Bronze’s Director & Co-Founder Shares Her Strategies for Launching a Loyalty Program, and More Advice from Shopify Experts

Megan Wenzl | Apr 5, 2024

Dec 8, 2023 | 12 minute read

Megan Wenzl

Content Marketing Manager

Acquiring new customers is undeniably crucial, but what also drives success is your brand’s ability to keep customers coming back. With customer acquisition costs rising, retaining your existing customers is a significant part of a growth strategy. Not to mention how it’s a testament to your ability to consistently delight consumers at a time when they have more shopping options than ever before.

Enter customer retention metrics, a toolkit necessity that enables you to understand your customers better to help you create long-lasting relationships with your Superfans (your highly engaged brand advocates). The right customer retention metrics can help you gauge the health of your customer relationships, identify areas for improvement, and ultimately solidify your position in the market. But what customer retention metrics should you track?

In this blog, we uncover the seven key indicators you need to monitor the strength of your customer relationships, as well as how you can use them to master customer loyalty and enhance success.

Customer retention metrics assess the effectiveness of a brand’s strategies in keeping customers engaged, satisfied, and loyal over time. These metrics provide a structured approach to understanding the strength and longevity of the relationships you’ve built with your customers. They offer insights into whether your products, services, and overall customer experience are meeting or exceeding expectations, as well as how well you’re retaining your customer base.

Customer retention metrics matter for a multitude of reasons, each contributing to the overall health and growth of your business.

Selecting the right customer retention metrics is crucial, as tracking the wrong ones can lead to misguided strategies and wasted resources. So, how do you determine which customer retention metrics are the most relevant for your business? There’s no one way to decide this. In fact, there’s a myriad of steps you can take – things to think about – before you choose which metrics to measure.

These include:

We know there’s a lot to think about for DTC brands. With this in mind, we’ve compiled our seven essential customer retention metrics, providing explanations, insights, and practical tips for measuring and improving each one.

Customer Churn Rate, often referred to simply as churn, is one of the most fundamental customer retention metrics. It measures the percentage of customers who have stopped doing business with your company within a specific time frame. The churn rate is a critical indicator of customer dissatisfaction and the effectiveness of your retention efforts.

And don’t worry. You don’t need to be a math wizard to figure it out. The simplest way to calculate churn rate is:

For example, if you had 500 customers at the beginning of the month and 30 customers canceled their subscriptions during that month, your churn rate would be:

Churn Rate = (500 – 470) / 500 = 6%

A high churn rate can be a cause for concern, as it indicates that you’re losing customers faster than you can acquire new ones. If this is the case, you may need to analyze and improve the quality of several key aspects of your customer experience, including customer support, product quality, and marketing communications. Another effective way to reduce churn is by implementing a loyalty program, offering customers discounts or exclusive offers to incentivize them to stay.

While the Customer Churn Rate measures the percentage of customers who have left, the Customer Retention Rate provides a complementary perspective by showing the percentage of customers you’ve successfully retained over a given period. This metric is a direct reflection of your ability to keep customers engaged and satisfied.

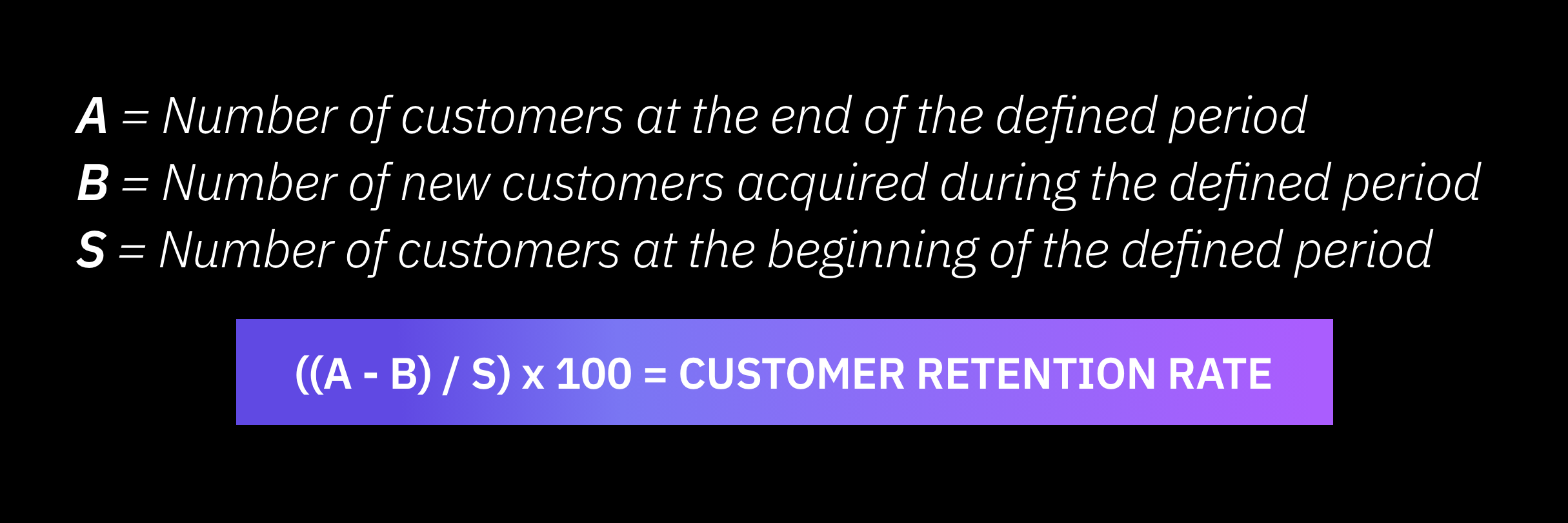

To calculate your customer retention rate:

For example, if you had 500 customers at the start of the month, acquired 50 new customers during the month, and ended the month with 470 customers, your customer retention rate would be:

Customer Retention Rate = [(470 – 50) / 500] x 100 = 84%

A high customer retention rate is a positive sign, indicating that you’re effectively keeping customers loyal and engaged. To maintain a high retention rate – and improve on it – you might again consider introducing a loyalty program to reward your shoppers’ continued patronage. 83% of consumers are more likely to continue doing business with brands that offer a loyalty program. Leveraging surveys and reviews, you should also continuously seek feedback about your loyal customers’ experiences and use this feedback to enhance your offerings.

Repeat Purchase Rate, also known as Repeat Customer Rate or Customer Repurchase Rate, measures the percentage of customers who make multiple purchases from your business over a specific period. This metric is another strong indicator of customer loyalty and the effectiveness of your marketing efforts to encourage ongoing engagement.

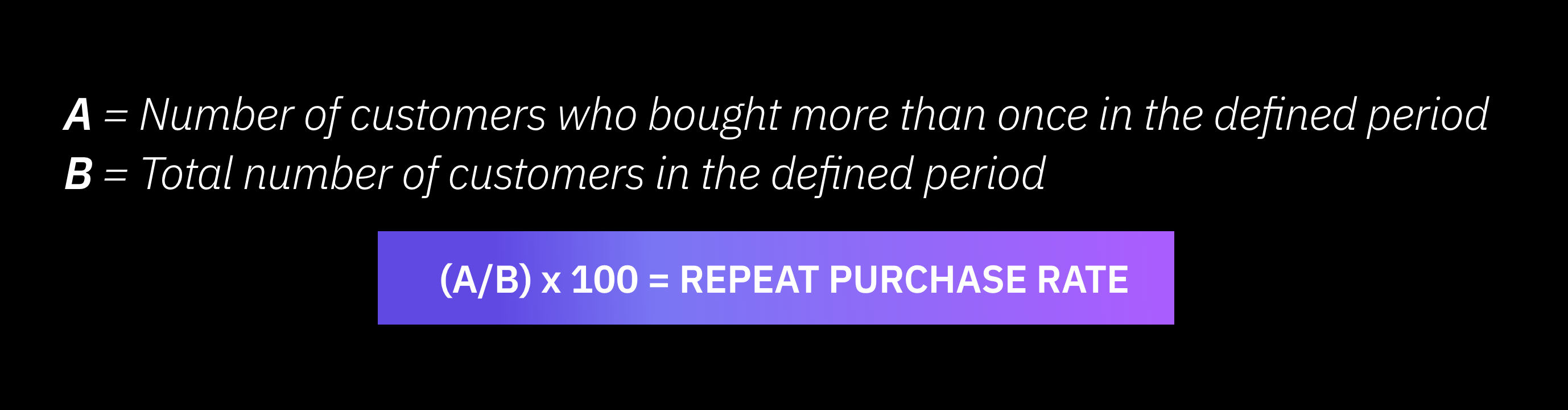

To calculate your repeat purchase rate:

For instance, if you had 800 unique customers in a month, and 200 of them made more than one purchase during that time, your Repeat Purchase Rate would be:

Repeat Purchase Rate = (200 / 800) x 100 = 25%

A high Repeat Purchase Rate suggests that your customers are not only satisfied with their initial experience but are also coming back for more, which is a sign of a strong customer relationship. On the other hand, a low repeat purchase rate may indicate issues with product quality, customer service, or the overall customer experience. This is why sending post-purchase review and survey requests is so important, as they collect valuable insights into what your brand does well and even more importantly, where improvements can be made.

Average Order Value measures the average amount spent by a customer in a single transaction. This metric provides valuable insights into purchasing patterns and helps your business understand how your retention affects the average amount each customer spends per checkout.

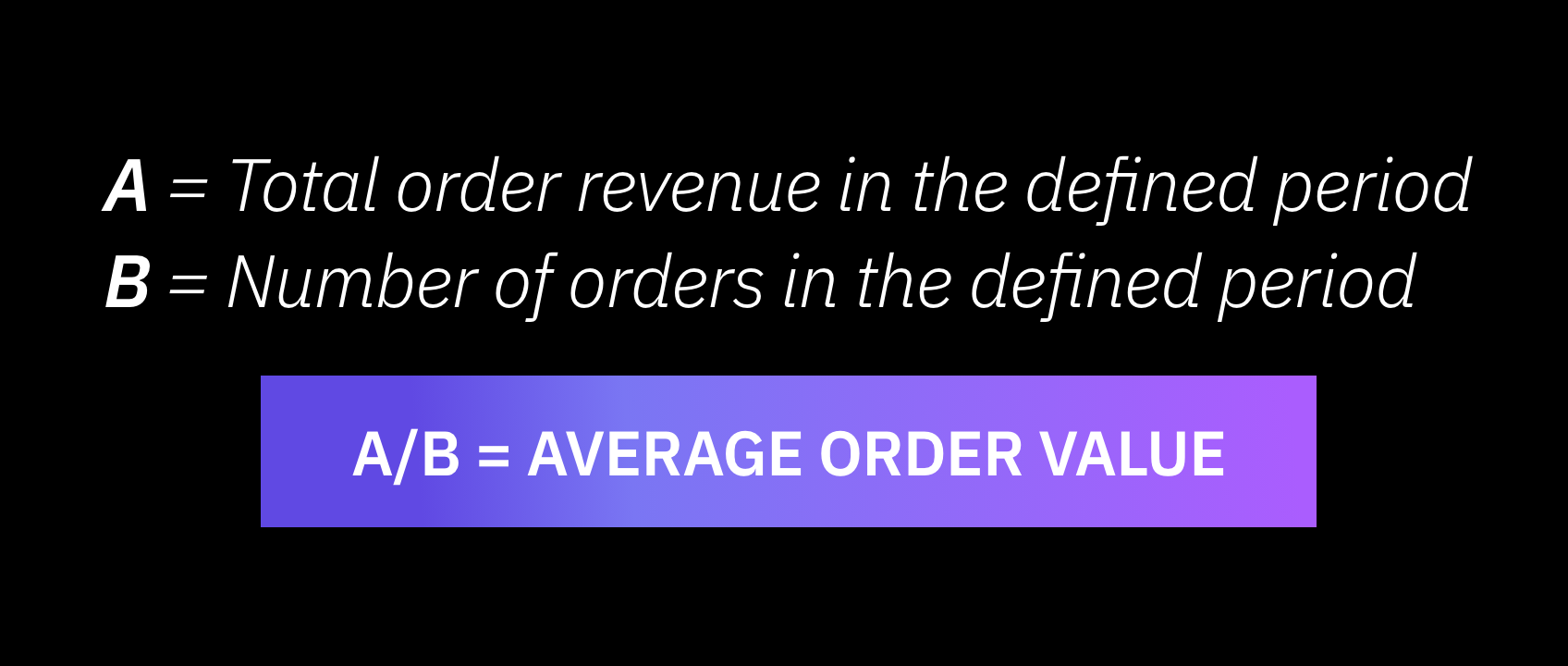

To calculate Average Order Value:

For example, if your total revenue for a month is $10,000, and you had 500 orders during that period, your Average Order Value would be:

Average Order Value = $10,000 / 500 = $20

Naturally, you want your average order value to be high. Marketing campaigns can help you achieve high AOV. Cross-selling, upselling, and bundle offers are all effective ways to encourage customers to add more items to their cart and spend more money. Loyalty programs can have the same impact.

Customer Lifetime Value (CLTV) is a comprehensive metric that calculates the total revenue a business can expect from a single customer throughout their entire relationship. It takes into account the customer’s average purchase value, the frequency of purchases, and the duration of the customer’s relationship with the business. It’s a particularly important metric to track if you’re looking to see which customer segments are most profitable (to help you focus your retention efforts most productively).

Calculating your customer lifetime value necessitates a few steps:

After you’ve made those calculations, you’ll be able to work out Customer Lifetime Value using the following formula:

For example, if the average purchase value is $50, the average purchase frequency is 2 times per month, and the average customer lifespan is 12 months, the CLTV would be:

CLTV = $50 × 2 × 12 = $1,200

A high Customer Lifetime Value indicates that your business is not only acquiring customers effectively but also retaining them and maximizing their value over time. By focusing on strategies that enhance CLTV, you not only drive sustainable revenue but also build a loyal customer base that becomes a valuable asset for your business in the long run. Regularly monitoring and optimizing CLTV ensures that your customer retention efforts are aligned to maximize the overall value derived from each customer relationship.

Customer Acquisition Cost (CAC) calculates the average cost your brand incurs to acquire a new customer. Understanding the cost associated with acquiring customers is essential for evaluating the efficiency and sustainability of your marketing and sales efforts, and determining whether your business can become profitable over a defined period of growth.

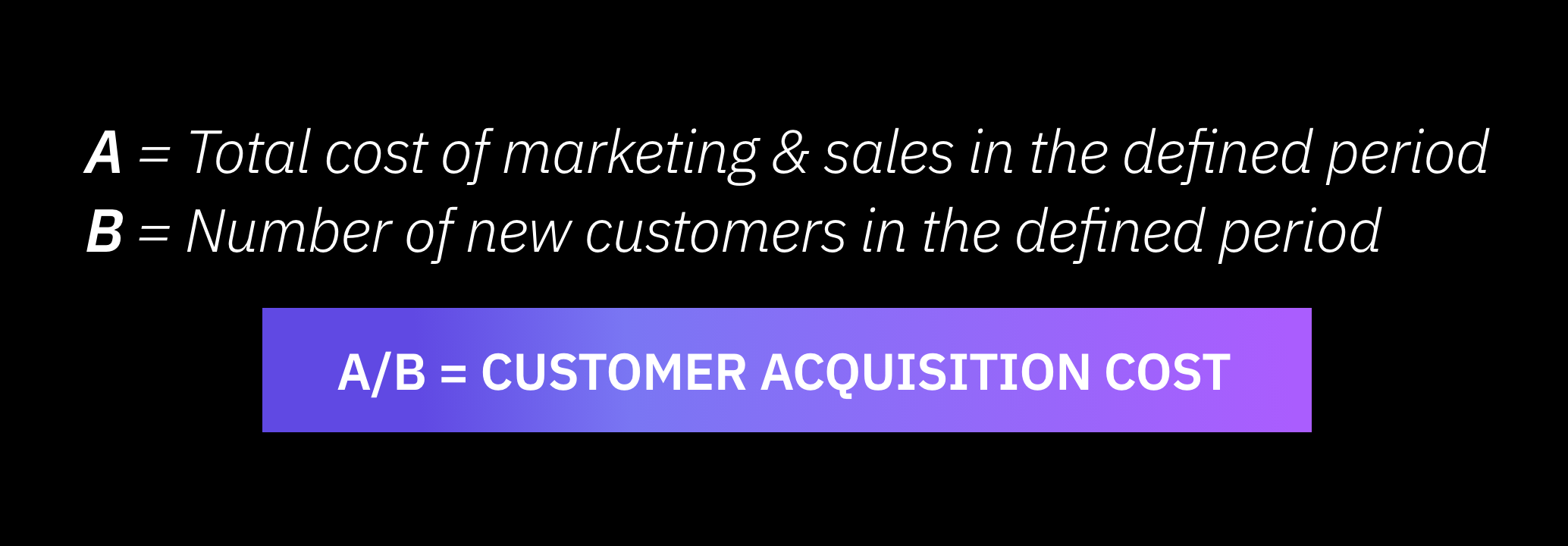

To calculate your CAC:

This means if your total marketing and sales expenses for a month are $10,000, and you acquired 100 new customers during that time, your CAC would be:

CAC = $10,000 / 100 = $100

Optimizing CAC is vital for maintaining a healthy return on investment and ensuring the long-term profitability of your customer acquisition strategies. Ideally, you want to acquire customers at a cost that allows for profitability throughout their relationship with your brand.

Net Promoter Score (NPS) is a popular metric that assesses customer loyalty and satisfaction by gauging their likelihood to recommend your products or services to others. It provides valuable insights into overall customer sentiment and can be a powerful indicator of your brand’s reputation and growth potential.

NPS is based on a single survey question that asks respondents:

On a scale of 1-10, how likely are you to recommend our brand/product/service to a friend or colleague?

It classifies those who choose a rating of nine or 10 as “promoters”, “passives” as those who rate either seven or eight, and “detractors” as those who provide a rating below six. To calculate your NPS, you then:

Based on this, your NPS will fall between -100 and 100:

For example, if 40% of respondents are promoters, and 15% are detractors, the NPS would be:

NPS = 40% – 15% = 25

Because NPS measures your brand’s overall performance, rather than your performance on just a single transaction, it’s a great way to understand and influence customer loyalty. It also enables you to identify your most loyal customers, and use them to guide improvements in products, services, or customer experiences.

By ensuring you have a firm handle on the current state of your customer retention, you can easily monitor the improvement that your enhanced retention strategies bring.

Okendo’s customer marketing platform helps brands mobilize their Superfans for faster and more efficient growth. To learn more, check out our guide to unified customer marketing.

Related articles

Ready to learn more?